Benefits Of Transferring Your UK Pension Plan To Indian QROPS

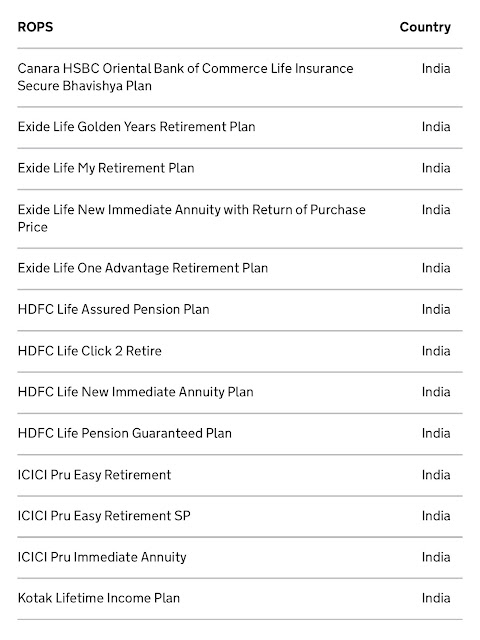

If you’ve worked in the UK at some point in time and have now moved back to your own country, your pension will continue to be held by your pension provider in the UK, until you claim it at the age of 55. They say “a bird in the hand is worth two in the bush,” and that rings especially true when you’re ready to retire. Apart from the inconvenience associated with having your pension reach maturity in another country, here are some of the advantages associated with transferring your pension fund to India. Opportunity to invest in schemes with guaranteed interest rates up to 10.5% Easy access to your pension in INR, nullifying any loss due to exchange rate fluctuations during the retirement phase. Higher growth opportunities with one of the world’s largest and fastest-growing stock markets and higher interest paid on bond markets. No inheritance tax in India, so your nominee gets the entire amount in case of an eventuality, as opposed to only 45% for the UK. Transfer of...