QROPS-Transfer your pension from UK to India

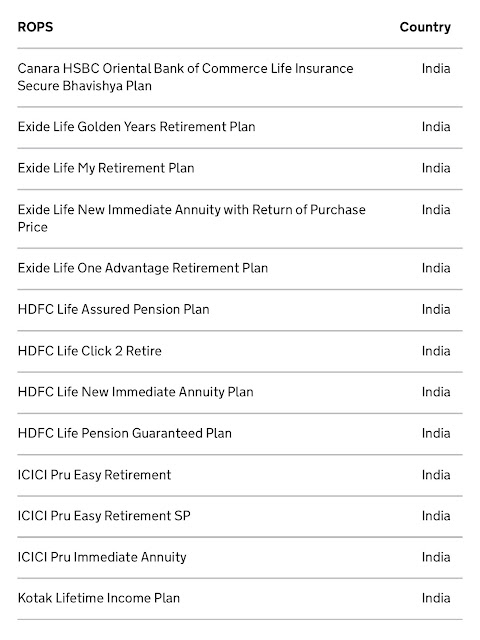

QROPS Since April 2006 as a direct result of EU human rights requirements of the freedom of capital movement, individuals have been able to transfer their pension savings in a UK registered pension scheme to a Qualifying Recognised Overseas Pension Scheme (QROPS). If you are an Indian or a Person of Indian Origin having accumulated Pension Funds in UK, you can now transfer your pension savings to a Qualifying Recognised Overseas Pension Scheme (QROPS) in India. To be a QROPS, a pension scheme must be based outside the UK and meet certain requirements stipulated by the HMRC, UK. Transfers to QROPS can be Tax Free if the individuals transferring their UK Pension Benefits, reside in the same country where the QROPS is established. Reasons to consider before moving your pension funds from UK to India 1 No Inheritance Tax (as per prevailing tax laws in India) - Leave behind the purchase price amount for your beneficiary without any tax liability. 2 After age of 55 w...